RMEx 2.0 Release notes

The following information outlines the new features in RMEx Version 2.0 and there is one important feature of note. Release 2.0 provides the infrastructure to support the ‘RMEx GUI’, our new graphical user interface. Some of the features have supporting GUI screens – so please take some time to review our new features. However, installing release 2.0 does not require the GUI install.

This release contains many new features that will enable you to work faster and smarter ~ increasing revenues while reducing costs. We hope that you take advantage of these new features! Some of these features will require a server. Please talk to us before moving forward so we can assist with the requirements for the server based on the features you wish to implement. We will have the technical specifications available shortly.

Also, take some time to review our training and documentation found on our website for further information regarding these features.

Graphical User Interface GUI

RMEx Management Dashboard

Permission Tracking

Dynamic Scoring

Events

Security Logging

Smart Phone Access - Reports

Emailing Letters

I-Tel Other Changes

Linking

Screen and Call Recording by User

Automating Agent Commission

Graphical User Interface (GUI)

We have all known this day would arrive. The dumb terminal has reached its pinnacle of effectiveness and has been slowly discarded over the years. So, it is with great pleasure that we introduce our new graphical user interface (GUI).

This product revolutionizes the interaction between the agent and the system. The implementation of a graphical user interface gives the best of all worlds: it uses the proven IBM servers that you have been using for years because of their reliability, security and low cost of ownership; it uses the same database technology and software that has supported your business since you implemented RMEx; and it presents all your data in a modern, user-friendly manner in a web based environment that you can deploy anywhere!

The RMEx GUI is a fantastic product that will change the way you work, letting experienced agents work faster in a more compliant manner and reducing the learning curve and training time for your new recruits.

Some of the new features will require GUI to be in operation. In fact, future releases will build on this interface. One of these features is Event Processing (Release 2.0). In previous releases, agents had to enter smart codes to describe certain events such as leaving a message on an answering machine, confirming a right party contact, recording a promise to pay, or confirming the debtor’s SSN or source of funds. With the GUI and event processing, the agent will no longer need to remember to talk about each item, or remember which smart code to enter: a window will appear containing each action pertinent to that account, and the agent will just tick boxes on the screen. The advantages for compliance, work standards, and agent productivity are enormous.

Clients who do not implement the GUI will not be able to use Event Processing. Future developments will be based around the GUI because there is so much more flexibility. For example, you can’t click on an account note to hear a call recording if you are using a green screen! Watch for this in Release 3.0.!

Remember, the sole advantage of a graphical user interface allows the user to interact with a program, which takes advantage of graphical components, in order to deliver a more friendly and intuitive platform.

You will need a Windows server to run this application and this server must be able to access your RMEx server (your i5 or AS/400) through your internal network. The GUI, the Smart Phone Access feature and the RMEx Dashboard can all use the same server, and Quantrax can set this up for you.

We want all our clients to move to the GUI and we have priced this very attractively so that the investment will not be an impediment to moving forward. We can provide trial versions of the GUI for those interested in getting started. There is no maintenance fee applied to the GUI: maintenance and support for the GUI is included in your standard RMEx maintenance fee. The GUI is licensed separately from RMEx. A licensing fee will apply, based on the number of users. Our most recent users will have purchased a license for the GUI with their license for RMEx.

Management Dashboard

The RMEx Dashboard allows you to monitor collection performance at a glance. All the key performance indicators are displayed on one screen. This data is updated every 15 minutes.

The number of calls, contacts, promises and payments for a client or a group of agents can be displayed. Additionally, more details are provided on any sub-set of data. This is an extremely powerful tool that can be used at different levels within your company. Executives can use it display financial performance information such as total collections or commissions for the entire organization. Managers can use it to display work output on a given portfolio, such as the number of calls made and the number of right party contacts. And supervisors can use it to display collections performance, such as the number of payments promised, for their team of agents.

So, there is no need to access green screens or run different reports to capture client and agent payment information. The new Management Dashboard allows you to check agent productivity and client rankings all from one location.

How many attempts, contacts, promises and payments have been made today, month-to-date, year-to- date?

Who are the top 5 ranking agents, groups of agents and clients?

You will need a Windows server to run this application and this server must be able to access your RMEx server (your i5 or AS/400) through your internal network. The RMEx Dashboard feature uses the same data as the Smart Phone Access and can use the same server.

Below is just one of the many information displays that are available with this feature.

Permission Tracking

Permission Tracking allows you to control how telephone numbers are dialed. Using this feature will reduce complaints, compliance infractions and, most importantly, lawsuits.

This new requirement is becoming more prevalent in the marketplace: it necessitates obtaining permission from the consumer to call them at certain numbers. Regulations for cell numbers have already been put in place. Some large banks now dictate that agencies cannot call consumers at any number using a predictive dialer unless the consumer has previously provided permission to do so. Agents must call first in preview mode and ask permission to contact the consumer at the number dialed (or any other number). If the consumer grants permission, then that number can be included in a subsequent predictive campaign. If the consumer refuses permission, then the agency must remove that number from their records and never call it again. RMEx now includes the necessary controls to adhere to this requirement and track when permission was provided so that this information can be reported to the agency’s clients.

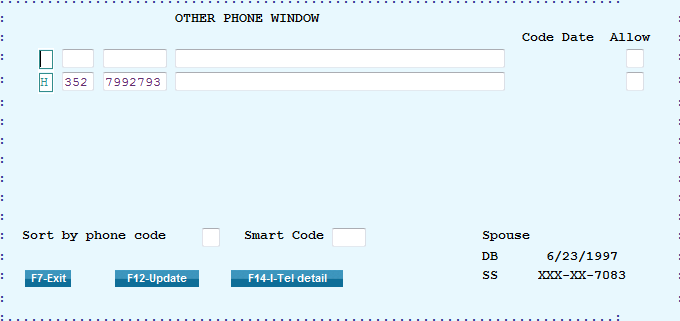

You can select Permission Tracking at the client level. This allows you to use the feature for one client but not for another. Phone numbers stored on the main account screen are deemed to have permission. This allows those numbers to be included in predictive campaigns on the day you implement this feature, without having to run conversion programs.

When you turn on Permission Tracking, and the agent is using the TAB+ window to call the consumer, the Permission Tracking window will appear as soon as the consumer answers the phone. This will prompt the agent to ask for permission to call the consumer at that number. The agent must respond to the prompt with either a “Y” (Permission granted), “N” (Permission refused) or Blank (where the agent could not determine permission, such as when the call is answered by an answering machine). If permission was not granted, the phone code will be changed to lower case, rendering the phone number ineligible to be dialed at all with the dialer. If permission was granted, then this number is marked as such and can be included in subsequent predictive campaigns.

If the agent uses the TAB+ window and preview dialing to call a number that already has permission, the permission window does not appear. The agent can update the permission flag for each number on file for the consumer from the TAB+ window. Notes are applied for every update to provide a detailed audit trail and you can use the date and time of the note to locate the call recording of the consumer granting permission.

Permission Tracking is an important component in the RMEx suite of features to enforce compliance in calling strategies. You can use this in conjunction with I-Tel and Cell Phone Scrubbing to control how you dial consumers and avoid the financial consequences of non-compliance.

Remember, this feature is ONLY applicable for phone numbers dialed out of the Tab + Window.

Once permission has been changed from Blank to a “Y” or an “N”, we will not prompt the agent again when they call the same number. The agent will have the ability to change the Permission Status, but there are rules.

They can change a Permission Code from a Blank to a Y

They can change a Permission Code from a Blank to a N

They can change a Permission Code from a Y to an N

They can change a Permission Code from a N to a Y

They cannot change a Permission Code from a Y or N to a Blank

When an agent has a debtor on the phone and there are additional phone numbers in the Tab+, the agent can speak to the debtor about those numbers and get permission for future use.We will notate the accounts with the outcome of the request when the agent responds to the request. In the event that the agent does not respond to the request, the system will still notate the account.

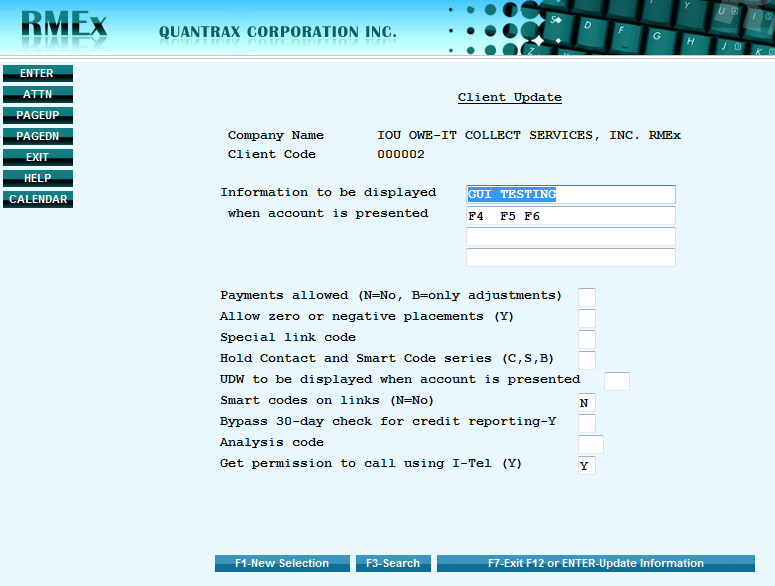

To turn this feature on, you will need to set the flag “Get permission to call using I-Tel” to a “Y” in the Client master file.

Once you have turned the flag on at the client level, you will also need to set up the phone codes, other than Phone Codes H, W or C, to prompt the agent to ask for permission.

A “Y” in any of 3 fields shown below will prompt the agent to ask for permission.

Debtor home phone (Y)

Debtor work phone (Y)

Debtor cell phone (Y)

To recap - the client flag must be set to “Y” and at least one of the debtor phone areas mentioned above must have a “Y”.

Dynamic Scoring

Quantrax has created a new “scoring mechanism”. It is called “Dynamic scoring”.

What is Dynamic Scoring?

Why is it called Dynamic Scoring?

Why would Quantrax develop another scoring process if there are already other ways to score accounts?

How can implementing another score, based on an occurrence, help to change the outcome of the account - or how that account is worked e.g., what kind of effort or revenue is put behind an account?

How can you change the Dynamic score without using ‘events’?

Does GUI need to be installed to use Dynamic scoring?

Dynamic – “often refers to a process or system that is distinguished by constant change or progress”

Collection companies should use some form of scoring to identify accounts that are likely to pay, and accounts that probably won’t. This is done to concentrate resources on accounts that will return revenue, and avoid expense where there will be no revenue.

Typically, scoring is done at the time the account is first placed and thereafter, never changed. This works very well at first, but after a couple of months, the process starts to fail. This is because the accounts that are collectible have been collected, and the accounts that are left are not, even though they may have high scores. Companies continue to focus resources on these accounts, even as the probability of a payment decreases. Similarly, accounts with lower scores do not get the resources they need to secure payments, resulting in lost revenue.

Dynamic Scoring changes all of this.

Dynamic Scoring is the process of recalculating the score on an account after a collection event has occurred. Clients will determine what events are important in their environment and how the score will be changed. For example, a high scoring account that has been called several times at numbers that are out of service is not as collectible as it was at placement, and the dynamic score will fall. Similarly, a low scoring account with a promise to make a partial payment now has more revenue potential, and the dynamic score will rise. These are just two of over a hundred events that can trigger a change in the dynamic score. Some events are automatic, such as when you receive a new telephone number from a data scrubbing company. Some are agent generated, such as getting an RPC or a promise to pay at a specific number. Every event is customizable, so that you can choose to change the score up or down, and by how much, or not at all.

By using Dynamic Scoring, you will be able to focus resources on accounts that are collectible today, rather than on accounts that were considered collectible by a third party score code, that may be months old. Furthermore, the dynamic score is based on your own collection activities and can change with every activity. The dynamic score is always up to date and removes the need to re-score accounts with a third party.

Currently, there is an internal score and external scores. The internal score is handled through RMEx and is applied to an account through smart codes. As long as there is an association between an incident and a smart code, this score can be adjusted up or down by applying the smart code. External scores (there are several), are usually obtained through a third party. These scores are static.

What if you could apply a system of scoring that would apply a value to account information at the time of placement and throughout the life of the account based on certain data?

account data (POE information received, a home number, a work number received or SSN received) at placement

client factors (client allows suits, client accepts settlements)

events during the life of the account (debtor has 30 linked accounts with no payment, check was returned, debtor sent letter of dispute)

This would indeed be beneficial! This is Dynamic Scoring and Events! An account is affected by the events that occur over time and ‘Dynamic scoring’ allows each event to add or subtract from the initial score on the account. Now we have a ‘Dynamic’ score that effectively allows you to evaluate an account more closely and in turn make decisions – changing dramatically how you would have handled this account!

Updating the Dynamic score:

A one-time conversion program has been created that will calculate the Dynamic Score for accounts that have already been worked.

Additionally, a program will run every thirty minutes to analyze the accounts and determine if the scores should be increased or decreased based on the following:

At the time of placement

On the existence of linked accounts

Third Parties (skip tracing, external scoring, bankruptcies, etc.)

Results from working the account (smart codes applied, updating an account)

Payment Posted to the account

Linking processed in the nightly

GUI does not have to be installed to run Dynamic scoring. However, you will want to install GUI to implement ‘Events’. Dynamic scoring and Events should be run together so that you can maximize the benefits of Dynamic scoring. If GUI is not installed, a table ‘Dynamic Score by Smart Code’, will need updated that associates a Dynamic score to a Smart code or multiple smart codes.

Events

Events are actions, that when triggered, will update the Dynamic Score.

Important aspects concerning Events:

Eliminates the need to primarily use smart codes to update accounts

Eliminates the need to update the Dynamic Score by Smart Code table

Smart codes are mandatory for all events

The rules set up at the Smart Code level will be enforced when an agent selects an event

Up to 99 sub events can be created

Intelec has always been an event driven system. A collector works an account and based on the information gathered (event), the agent enters a Smart Code to update the account. With RMEx2, they will no longer need to remember Smart Codes; they just need to click on the appropriate series of possible events. These events are different than the System Events discussed above and will eliminate the need for collectors to remember Smart Codes.

Instead of using the Smart Code Window, the user will need to click on the Events Button to start the process. Then the user will be prompted and presented with different options relating to what has occurred on the account:

For example, you have a Main Event – the first in the series of events – it is Attempt Made. The user will click on this event first.

Another window with Sub Events will be displayed, such as, Called Home and Called Work. At that point, you could stop the agent and force them to tell you what happened by entering notes “No Answer or Left Message. Or, when they clicked on Called Home, you could present them with more Sub Events like, Left Message or No Answer.

As you can see, the agent never applied a Smart Code, so the agent does not have to remember what Smart Code to apply. The process is controlled and naturally directs the agent to enter the pertinent information, thus working the account without smart codes.

When a ‘User Defined Event’ is entered, a Smart Code can be applied and the dynamic score code can be adjusted on the account.

Main Events –

Main Events are the first line of action from which all sub events occur.

There is a System Control file containing the system defined “Main” events where you will have the ability to create and link Sub Events to the Main Events. The events and sub events will:

Apply Smart Codes from each event

Force the users to follow the applied Smart Code rules

Associate a Dynamic Score Code to an event in order to adjust the debtor’s score

Sub Events –

Sub Events are all subsequent events originating from a main event.

Sub events at the first level are single character alpha fields

So, there are only 26 - 1st sub level events available

As you add sub levels, the system will assign the next alpha character available (AA - AAA – AAAA)

There is no hierarchy to the sub levels. We are simply associating a sub level to a main event (or from another sub level)

Security Logging

Security standards are always changing, and they always become more stringent. Most users of RMEx are required to comply with one or more of the following standards: ISO17799, ISO27001, PCI, and SAS 70. As these standards evolve, and as new technologies and threats emerge, RMEx is constantly being enhanced to ensure that you can pass the security audits that your clients impose upon you.

One security control that security auditors are now looking for is activity logging for key files within an application. If this issue has not yet appeared on your ‘Security Controls Remediation List’, it will soon!

Activity logging is the requirement to maintain a record of who changed what, and when, on a key data file within an application. Also required is the ability to enquire on the log file, to determine when a particular record was changed, or to review all the changes made by a particular person.

Whenever a user makes a change to a key file, a record will be written to a log file. The log file will contain the user-id of the person making the change, the date and time, an indicator showing whether this record was created, changed or deleted and an image of the record before it was updated. There will be one log file for every major file in RMEx.

Authorized users will be able to enquire on a log file by date and time, by user-id, and by record key. The record key will depend on the file being logged: for example, if you are looking at changes on the client file, then the record key will be client number; if you are looking at changes on the agent file, then the record key will be the agent code.

We have identified the following files as key files that require logging. Logging for the first two files is included in RMEx 2.0, and the remaining files will follow in interim releases later in 2011.

Client

Smart code

RMEx Security profiles

Letter formatting

Letter codes and overrides

Close codes

Agent profiles

Smart code series

Contact series

State controls and options

Changes in Client Access by User ID

Company Information/System Parameters

Payment Codes

Description Codes

Work Groups

Now, whenever a user makes a change to a key file, a record will be written to a log file containing an image of the record before it was updated. Depending on which file you are in, hitting the Enter Key and/or the F12 Key (Update) will create a record.

Now that Client and Smart code files have been set up for logging you will be able to:

Display a list of all users that have made changes to the files

View the changes for a specific Client or Smart Code

NOTE –

The client viewing options are only available through the Client Update option

As long as you have access to Smart Codes, the Smart Code logging option will be available to you as well

When viewing a logging list, it will be sorted by date changed or added

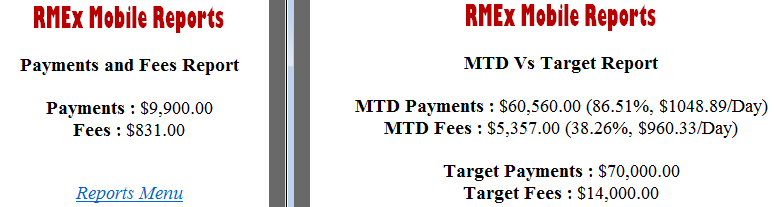

Smart Phone Access - Reports

You can now display key performance data on your smart phone!

Your Smart Phone will need a web browser to view this data. We have tested the functionality with Blackberry and iPhone. If you have a different smart phone, it should work as long as you have a web browser.

You will need a Windows server to run this application and this server must be able to access your RMEx server (your i5 or AS/400) through your internal network. The Smart Phone Access feature uses the same data as the RMEx Dashboard and can use the same server. This data is updated every 15 minutes.

The initial information displays included with RMEx 2.0 are:

Payments and Fees for the day

Month to Date vs. Targets for Payments and Fees

You will be able to select the initial displays by company code, as long as you have security access to the company code. You can control what users can view using the standard RMEx security features. You will be able to monitor collections performance from anywhere you have internet access without having to call the office!

More displays will be added to this feature in the near future. So, let us know the data you would like to see included and how you would like to see it presented e.g., by client, agent, company, etc.

Emailing Letters

We have added the ability to email letters to consumers.

Once you have obtained a consumer’s email address, Selected and Contact Series Letters can be emailed

You will save on postage, save letter printing costs, save time and costs on setting up new letters, save on returned mail costs, and save time on delivery

You can set up new ‘letters’ either as letters that will be mailed out as usual, or emails that will be sent to consumers electronically, or both

Letter ‘X1’ can be set up to be mailed and a different letter format ‘XE’ can be set-up if that same letter is to be emailed. Same letter content – different format. (This alternate letter may need to go through the same ‘new’ letter process)

If a consumer has an email address on file and you choose to send a ‘letter’ that is designated as an email, then the system will generate an email instead of a letter

The consumer’s email address is stored in the “Special Address” from the Tab Q window

Agents can also send emails instead of letters. They have the option to enter an email address and specify whether the letter is to be sent by regular mail, email, or both. Notes are added to the account to provide an audit trail of what was done

All emails are generated during the nightly process and go through the same normal edits that your current standard letters go through. The emails are then sent to your email server for transmission

We recommend a separate email server because it will be more efficient, but it is NOT mandatory. Contact Quantrax and we will provide you with the additional software “Emailing Letters RMEx 2.0" to load on your server.

Note: If ONLY an email is sent, it will be notated in the notes on the account. We are only tracking the original letter being sent. You can track emails that have been sent by applying a Smart Code or adding a Description Code from the Letter Code set-up screen.

When an agent enters a Smart Code and requests to send a letter they will have the option to email the letter.

If there is an email address on file, the email address will appear. Or, another email address can be entered over top the existing email address

Use the option ‘Send letter by email?’ to:

Y – email only

B – email letter and mail letter

N – do not email the letter

I-Tel Other Changes

Agents can now apply a Smart Code directly from the Tab + Window. This allows an agent to work through all the numbers on the TAB+ screen without having to exit back to the main account screen in order to enter a smart code

Agents can disconnect a call directly from the Tab+ window. The agent must enter an ‘X’ in the new Smart Code field and press enter. Unlike disconnecting a call from the first detail screen, the Tab after entering the X is not required

An agent can no longer dial a phone number from the Tab+ window where the Phone Code is lower case. This prevents an agent from calling numbers that have been disabled by the system

Accounts are now getting notated when a Phone Code is changed from an upper case to a lower case Phone Code. The notes can be seen on the F11 screen

Linking

New functionality has been added to linking.

Currently we have the ability, through the Linking Parameters, to change the Owner and Worker on the old account to that of the new account. This creates a problem if you want to take the old account away from the Owner but leave it with the current Worker. There is a new option in Linking Parameters called “Do not change worker”. If you put a “Y” in this field, and the worker on the old account is not the same as the owner, during the linking process, the system will change the Owner but not the Worker.

Screen and Call Recording by User

I-Tel, the integrated dialer for RMEx, has a call recording feature. Most clients already use this. You can configure the system to record any or all calls launched or received by the dialer. Managers can select call recordings by user, by specific call, by campaign, or blanket recording.

We now have a new feature called the Collection Center Monitoring System (CCMS). This feature records screen images as the agent moves from screen to screen on an account and matches them with the call recordings captured by I-Tel. CCMS also has a playback feature. Managers can use this to listen to a call recording and watch the screens viewed by the agent, and the data the agent enters, such as smart codes and notes.

The two principal applications for CCMS are:

Training and managing agent performance

Adherence to work standards

There is also a security benefit: the system tracks what the agent entered into the system and what was said during the phone call, and matches them together. This is emerging as yet another security requirement. Future placements by major clients are likely to be dependent on having the screen recording and call recording functions of CCMS in place.

The Collection Center Monitoring System (CCMS) is licensed separately from RMEx. The cost for your organization will depend on the number of concurrent screen recordings you need to take and the total number of I-Tel Call Recording licenses you already own. You will also need a server to store the call recordings and screen recordings.

Automating Agent Commission

RMEx now gives you the tools to manage commissions paid to agents based on the work the agent has done on accounts that have payments. The system will allow you to ‘measure’ the work done and adjust the agent’s commission accordingly.

The system is based on a table of activities and percentages. For example, if the agent has a right party contact with the consumer five days before a payment is received; you will probably want to pay the agent the full commission of 100%. Conversely, if the agent has never made any phone calls on the account, and the payment comes in as a result of a letter, sent as part of a contact series, you may want to pay the agent zero commission.

You can set the system up to reduce the commission payable on small payments, and increase it on large payments. For example, you may not want to reward the agent who gets a payment of $10, on a $3,000 debt. Similarly, you may want to increase the commission paid to an agent who gets a PIF on a large balance account.

The system is powerful and flexible: you can you enter rules based on right party contacts, the time between contacts and payments, and the amount of the payment, both in real terms and in relation to the placement amount. Also, you can make commission adjustments based on description codes! This allows you to code an account with a description code, using smart codes entered during your normal collection activities, and adjust commissions accordingly. For example, you could reduce commissions on visa payments but increase them for ACH payments taken over the phone today. The system is totally customizable.

This feature provides owners and managers the flexibility to increase or decrease (or even eliminate) the commission payable to the agent as required. Primarily though ~ it provides an easier way to give credit where due and less credit on costlier tools. An ancillary benefit would be the encouragement agents would have to collect more and larger payments, and sooner.

|

|

Copyright 2011 – Quantrax Corporation, Inc. |