|

DOCUMENTATION

FOR I-SCORE

Quantrax

will support I-Score as base code in Version 8.1 of Intelec. Users

who are on prior versions will run the processes described in a

different manner from Intelec 8.1 users. Quantrax

will support I-Score as base code in Version 8.1 of Intelec. Users

who are on prior versions will run the processes described in a

different manner from Intelec 8.1 users.

You will first work with Quantrax who will create models and analyze

your data. This will help you to understand if scoring your accounts

using I-Score can produce results for you or not.

Setting up the scoring process involves the following.

- When you

decide to use Quantrax for scoring, you will need processes to

select the accounts that need to be scored on a daily basis

- Quantrax

will create a file of the accounts to be scored and move the information

to a server at their office

- Accounts

will be scored and returned to you along with the scores.

- Programs

will read the scores, save them on the system and apply Smart

Codes based on rules that you set up

- There will

be statistics of accounts scored and payments generated from the

scored accounts

This documentation

will provide more details on the above.

Once you have

talked to Quantrax about having your accounts scored, they will

notify you when the programs have been set up on your system. When

the programs are activated you will have access to a new system

control file for scoring. You also have a little work to do to get

the process started.

Here are the required steps.

- Make a decision

about how you want to move accounts into the scoring process.

You can have complete control of the process and simply ask Quantrax

to work all of the accounts in User ID ISC1 (User ID used for

scoring only). We will be offering phone look-ups and there will

be different User ID's that will be used, based on the level of

service required. You can place some accounts in User ID ISC1's

queue through the use of Smart Codes and a change of worker code,

and also ask Quantrax to automatically add new business to the

scoring process based on certain parameters (during the nightly

processing).

- If you want

Quantrax to processing all your new business, Quantrax will use

programs that will read all the new accounts for the day. You

will need to tell us what company codes should be considered.

You can specify a minimum linked balance to be considered (we

suggest that all accounts are scored, regardless of balance) and

a description code that will omit the account (if that code exists

on any of the links). The description code could be applied to

accounts that you may not want scored (e.g. accounts previously

scored). You would add this description code when the account

is returned to you after it was scored or at the time it was sent

for scoring. The options for selecting accounts for scoring are

one of the following.

- Change

the worker code one that is associated with a User ID of "ISC1".

In this case, you will have to provide a Smart Code to apply

to the new business that qualifies to be scored. You also

need to give us the worker code that is associated with User

ID "ISC1". You can also use Smart Code though options

such as the multiple Smart Code assignment to move accounts

to the queue for ISC1.

- Another

method is for Quantrax to analyze all of the the new business

for the day (during nightly processing) based on the company

code, a minimum linked balance and a description code to be

used to omit an account. In this case it is not necessary

to supply a Smart Code. The account can remain with the existing

worker code and User ID and can be scored and returned for

you to take the necessary action.

Note that if there are multiple linked accounts for the same

debtor, we will only score the debtor and count the account

once.

Summary - To have Quantrax select accounts from within your

new business, you will need to give us

- the company

codes to be considered,

- a minimum

linked balance to look for,

- a description

code to omit accounts,

- a Smart

Code to apply to move the account to the worker code associated

with User ID ISC1 (only if you want to change the worker code

or update the account in some way) and

- the code

in Intelec for the worker that is associated with the User ID

ISC1. (This should be provided if you move accounts to that

worker code and want them to be included in the scoring)

- You will

need a Smart Code that you can use to have existing accounts scored

(e.g. through a multiple Smart Code assignment). If you set up

a Smart Code for new business, you can use the same Smart Code

for this too (We can select new business without using any Smart

Codes, as described earlier). You could duplicate the Smart Code

on linked accounts and keep all of the linked accounts in the

scoring worker code. Since accounts would be scored quickly depending

on volumes, you can have us select from all the new business and

not move the accounts into a special worker code.

- You will

need to set up Smart Codes to be applied to the accounts once

they are returned after being scored. Quantrax will talk to you

about your environment and the score ranges from the accounts

that were tested. You will need to set up codes for the different

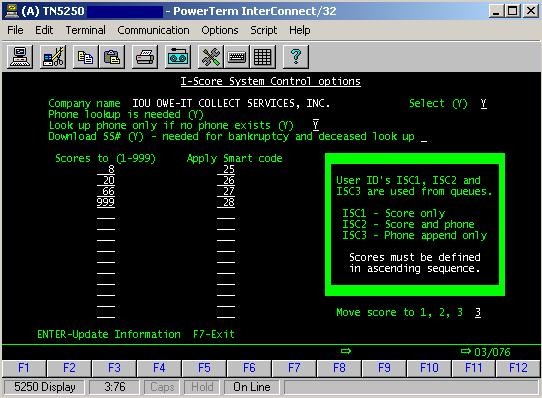

ranges of scores based on your workflows. Following is the screen

displayed when the System Control file for I-Score is displayed

by taking option 15 from the 3rd System Control menu in Version

8.1, or by keying in the following from a command line for all

prior releases.

call

uiscor

- The system

control file must be set up for all companies where scoring

is required. When we do out initial tests, we have to create

the system control information. You may therefore find some

of the information already set up.

- "Select

(Y)" is required to set up scoring for a specific company

- "Phone

lookup is needed (Y)" should be set up when you start

using the phone lookup service along with the scoring

- "Download

SS# (Y)" is only required if you require the bankruptcy

and deceased lookup options

- Based

on the scores obtained from the analysis done by Quantrax,

you can define up to 14 scores and the corresponding Smart

Codes to be applied. You must set up the scores in

ascending sequence. You should always set up the last

score as 999, so that all scores have a Smart Code. (We will

provide scores in the range 1 - 999.) You can set up the Smart

Code to do anything, but it is recommended that you duplicate

the Smart Code (so all of the linked accounts move together)

and also add a description code that will be used to stop

the account from being scored over and over again. We will

later provide options for re-scoring accounts based on the

last time an account was scored.

- You can

save the I-Score value in one of the 3 Intelec scores and

use it for decision-making. Set up the score field to be used

in the option "Move score to 1, 2, 3". The 3 scores

we refer to are displayed on the 2nd account detail screen,

reading from left to right.

-

Once the

system control files have been set up for each company, you

are ready to start scoring accounts. At the beginning of nightly

processing, we will take the last scores that were "uploaded"

and apply Smart Codes and save the scores on the accounts (all

linked accounts) based on the system control file. We plan to

run a "download" (get accounts that need to be scored)

at the end of the nightly process. We plan to download the the

accounts to be scored into our servers, around 8 AM EST. We

expect the accounts to be scored and information moved to your

system by 5 PM EST, well in time for your nightly processing.

Initially, we may use the iSeries modems, but we will work towards

an FTP process to move the files between the systems.

-

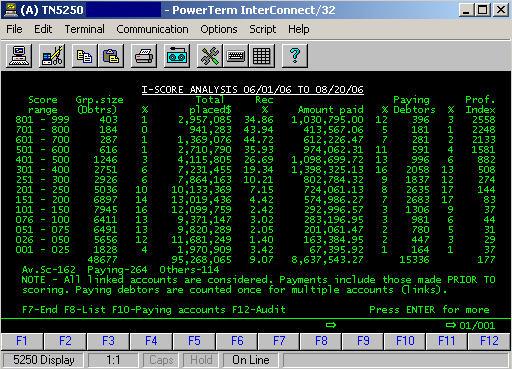

Analyzing

collection results based on the scores is also easy. We provide

reports that show paying accounts based on the range of scores,

as in the following example. In this option, we look at all

the linked accounts related to the accounts scored, taking into

account all the accounts placed (amount placed, regardless of

close codes) and the amounts collected from all of the accounts

regardless of the time frame (could have been before the accounts

were scored). The objective is to evaluate the accuracy of the

scores against accounts where payments were made. There are

other reports that only include payments received after the

accounts were scored.

To access the reports, from Version 8.1 and later, key in "IS"

(letter i and s) at any menu. Management Menu access will be

required. For prior releases, key in the following from a command

line

call iscorpcl

As you look at the screens and begin to think about how you

could incorporate scoring into your business model, you should

consider the following.

- No

scoring model can claim to accurately tell you who will and

will not pay.

- There

will always be collectable accounts that will be scored low.

Similarly, you will not collect from many high-scoring accounts.

- Scores

are an indicator and you are always responsible for evaluating

the reliability of any scoring system.

- Our

goal is to provide reliable results for a very large percentage

of the accounts scored.

- Giving

a lower score to some collectable accounts is not damaging

if those accounts get collected quickly or with a little effort

compared to the success with other low-scoring accounts. You

could consider using an additional credit score on some of

the lower-scoring high balances, to find out if they may qualify

to be considered more collectable.

- Assigning

higher scores to accounts that can not be collected will not

be costly if the number of accounts is small. You will have

fewer high scoring accounts and you will not be using a large

percentage of your resources on these accounts.

- Numbers

can also be deceptive. A single large payment can skew the

analysis and this must be considered carefully. In general

if a collectable account was placed in a low-scoring group,

there is a good chance that the account would be recovered

with minimal effort. While it is our recommendation that additional

resources and time be allocated for higher-scoring accounts,

we do not suggest that you put no effort on the lower-scoring

accounts! These accounts must also be worked, but worked economically.

In the following, Prof.Index is a profitability index. It

looks at the amount paid for each group, compared to the number

of accounts in the group. Assuming you put the same resources

into all of the accounts in the group, this index is an indication

of the amount collected per debtor, for accounts within the

group. The larger the number, the more profitable those accounts

are likely to be.

In the above, looking at all of the linked accounts

(some of the accounts for the same debtor could be much older than

the new account that was scored) and all the payments

that were received to date, allows you to evaluate the new scores

based on prior collection efforts for the same debtors. If most

of the payments were against accounts that had lower scores, you

would obviously question the accuracy of the scores. In the example

above, a larger amount and number of payments have been generated

from the accounts with higher scores.

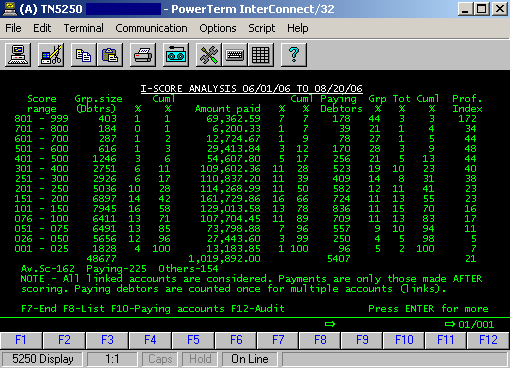

Now, let us look at the same group of accounts, but only consider

payments received after the accounts were scored.

Note the increase in the percentages of amounts paid and paying

debtors as the scores increase.

- Grp% is

the percentage of paying debtors calculated against the group

size.

- Tot% is

the percentage of paying debtors calculated against the total

number of paying debtors for all groups.

- Cuml.

% shows percentages for all the groups up to and including the

group referred to on that row.

-

The above

lists can be analyzed in more detail using the options that

allow you to list all the accounts (F8) or only the paying accounts

(F10) for a particular score range. In addition, you can select

a score range and work with those accounts through the account

audit feature (F12)! From within the account list you can select

and sort using the many options offered by the account audit

making the entire process very flexible and completely integrated

with Intelec.

For more information,

please e-mail ranjan@quantrax.com

|