Quantrax Corporation Inc. Updated March 27, 2006

Quantrax

Corporation is a software company that provides innovative technology solutions

for the collection industry in the United States and Canada. Intelec, an expert

system for collections was first installed in 1991. Today Quantrax supports

over 100 clients in the US and Canada, has its own high-end, integrated predictive

dialing platform. Capital Management Services is a nationally licensed and recognized

collections agency providing the highest level of delinquent receivables resolution.

Capital Management Services is one of the fastest growing receivable management

firms in the country.

This documentation refers to the manual skip-tracing service that Quantrax and

Capital Management Services are offering the collection industry. Quantrax markets

and supports a collection system called Intelec, and while Quantrax offers this

service to its clients, this document is specifically for non-Intelec users

who will be utilizing the service. Please refer to the white

paper on the same subject.

OVERVIEW

Depending on the collection software you use, you will need to identify the accounts that you want worked. These can be sent to us daily. We will have options for a basic search, priority basic search, detailed search a priority detailed search. You should think about creating a "file" for us at the end of your nightly processing. Note that detailed searches are not presently done. We will use the debtor's social security number, name, address, returned mail flag (indicator that the address is bad), home phone, work phone, POE, debtor DOB and spouse name from the account master. The more information we have, the more accurate will the results be. At a minimum, we will require:

We do not require any other key account information other than what was described (e.g. We do not want you to give us sensitive information such as client name, patient name, client account number, balances or medical information)

A phone number history (numbers

that were previously identified as being bad numbers on an account) will be

very useful. This will stop us from returning the same numbers. In Intelec,

we store these numbers and they can be easily identified. The information you

supply to us will be electronically transferred to Capital Management Services'

servers and worked remotely from

Accurint is the only service we presently use for our searches. We have access to all of the options that can be accessed through the Accurint system. Accurint is accessed through the Capital Management Services servers, with licenses provided through Capital Management Services. The account data we need will temporarily reside on their systems and be deleted after the accounts are worked. Statistical information will be retained in order for your results to be evaluated. Data never leaves the United States and is only stored on machines that are under the direct control of Capital Management Services or Quantrax Corporation. Note that we do not make any phone calls to verify information for debtors, relatives or associates.

Here are more details.

1. The accounts you supplied are manually skip-traced using Accurint.

2. All information was carefully reviewed to determine if a phone number could be obtained for the debtor at the address listed. If the address was bad (returned mail), we looked for a new address too.

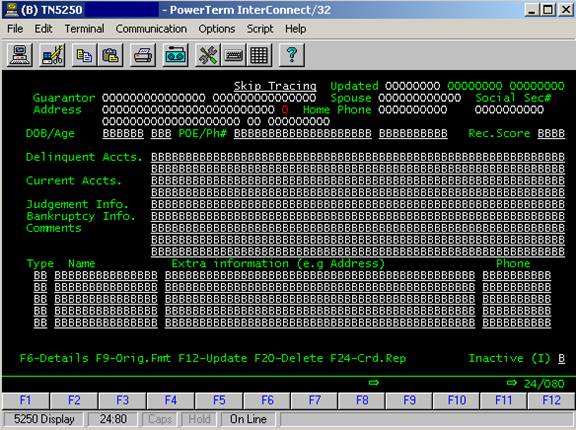

3. The following is a sample of the skip-tracing screen that the Intelec users see after we have uploaded information to their system. We will be uploading the results to your system and you will be responsible to populating the corresponding screens on your system.

4. If the address you gave us had returned mail and we found a new address, that will be sent to you and you would update the the address area of your account detail screen, dropping the old address into the notes. If we find a different address and the present address is good, we document that in the skip tracing data, in the area that allows name, type, address and number for additional parties to be entered. The type for debtor is “AD” (Additional debtor information). In Intelec, if we have a phone number for the debtor that is NOT at the good address on the account, that phone number will be added to the home phone number if there is no home phone number on the account. This will allow the new number to be dialed easily. You can decide now you would address this situation based on your collection system. Note that the phone may not be at the address on the account. If there is a phone number on the account, the number will be added to the notes (in Intelec). This is unlikely to happen because the accounts that are skip-traced will usually not have a phone number.

5. New debtor phone numbers will normally be moved into your account detail screen. If there is an existing number (unlikely) it is should not replaced. The new number could be added to the notes in this case. A new number could also be duplicated on all the linked accounts. You will need to program these rules into the process that takes our data and updates your system. If the skip tracing source indicates that a number may be a cell number, this could cause a problem on predictive campaigns. Such a number will be added to the skip-tracing data will a special code of "CE" for cell phone.

6. New debtor numbers found on Accurint are verified using the DA reverse lookup feature on Accurint.

7. We also provide 1st and 2nd degree relative information (name, address and phone) as defined by Accurint. These are written to the skip-tracing data we supply with a type of 1D or 2D respectively. Associate information is coded with "AS" in the type field. In the case or relatives, if degree information is not available, the information will be coded as "RE" for relative.

8. We add up to 5 "Skip Codes" per account". Phone found, address found, no phone found, no address found and no information found. That translates to 5 different Skip Codes you will need to program for on your system. You would write programs to do different things based on the codes supplied on each account. In Intelec, users will as an example, re-queue accounts, close them etc. based on the supplied codes.

9. We apply the phone found Skip Code if we get a new number for the debtor. We may also find a new address in this case. We will then apply the address found Skip Code too.

10.

If we find a new address for the debtor, we apply the skip code for "Address

found".

11. If no phone number or

address was found for the debtor but other useful information was found

(relatives or associates), we will apply the skip codes "No number found"

or "no address found" (for the debtor). We would supply note that

other useful information was obtained.

12. If NO information for debtor, 1st or 2nd degree relatives or associates

is found, we code the account with the skip code "No information found".

13. If you provide us with a list of phone numbers that were previously removed from the account (bad numbers), we will not return numbers to you as possible new numbers.

14. We will provide you with the debtor DOB and age, if they are found.

15. To explain special circumstances, the skip-tracers can also add up to 3 notes on an account that they work. You can use these notes as required on your system.

16. The information we supply should be used to update your system. The skip codes should be used to "status" your accounts. You are responsible to the programming required for this area. At a minimum, you would mark the accounts so they are not given to us again.

17. Statistics will be maintained by Capital Management Services. With Intelec users, payment information automatically updates statistics, so the user is able to evaluate the return on investment based on payments generated from the skip-traced accounts. You could have your technical teams develop simple reporting tools will allow you to monitor the work done by the skip-tracing service and evaluate the true value of the results and your collectors' efforts.

If you are on a system other

than Intelec, you will need to create your own reporting. Capital Management

Services will maintain statistics on the production efforts.

You can use the following information from Intelec to set up similar programming

on your systems.

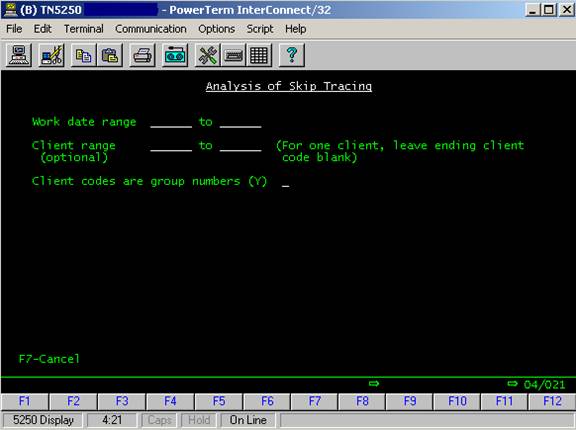

Within Intelec, the user has 3 reporting options. The "Skip-tracing analysis inquiry" allows you to select a date range. You can also select a client code range or group codes. Following is a sample screen for the selection.

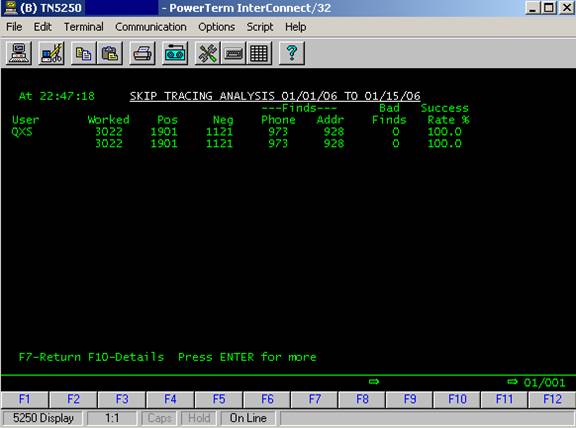

Based on what is entered, you will see the following information.

Note that a new debtor phone number or address is a positive find. Bad finds are updated when your collectors apply specific Smart Codes (see later on) to indicate that the find information supplied was not accurate.

Success rate is positive

finds less bad finds as a percentage of the total positive finds. We do not

differentiate between phone and address finds, but look at the positive finds

as a group.

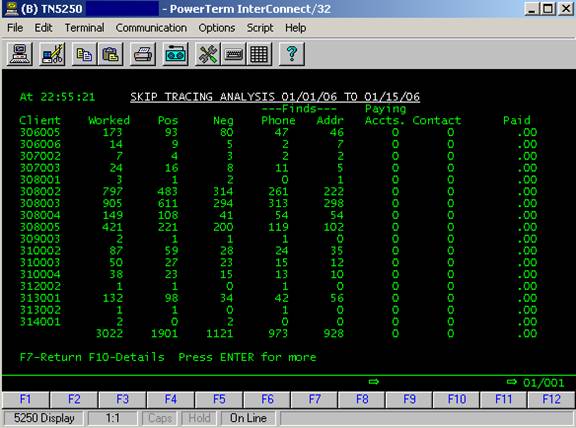

There are two other options. One is “Skip-tracing analysis with payments”.

This is similar in concept to the option described above, but additionally shows the payments generated on the accounts worked, after they were worked.

The selection options are similar, but we show the number of paying accounts, accounts contacted (will only be accurate if the user resets the contacts when the account was placed with the service) and amount collected. The data for these reports are automatically updated though payment processing and other Intelec features.

There other option is similar

but allows the user to analyze the results by client or group!

Note that there is a function key which will allows the user to print the accounts

that make up a specific line of the display. The user is prompted for a User

ID or client codes.

Following is a sample output for the client inquiry option.

THE COLLECTOR EXPERIENCE

You will to decide how

you present the skip-tracing data to your collectors. In Intelec, collectors

will see a new screen for skip-tracing information. In addition, users set up

2 new "Smart Codes" for their use. Let us expand on that. If we work

3000 accounts and have 1500 positive efforts, we will ASSUME THEY ARE ALL GOOD!

The accuracy percentage is 100% as soon as we finish working the accounts. As

collectors work these accounts, we need a method of saying "It was not

a positive find". You can do that by having the collector apply codes -

one for phone and the other for address. How this is implemented will depend

on your collection system and your requirements.

INTERFACE DETAILS

It will be important for you to understand what information we work with from your system, and what information we give back to you, along with your options for working with that information.

Here are the other details

of the "download" process (Data moving from your system to ours).

The following table summarizes the required data.

|

Field

|

Description

|

Starting

at

|

Ending

at

|

Type

(A/N) |

Required

or

optional |

|

Your

account reference#

|

The

unique number assigned to an account. Something we will pass back to you

to update your system.

|

1

|

25

|

A

|

Required

|

|

Debtor

name

|

Name

of debtor including middle name or initial if available and Jr. Sr. etc.

|

||||

|

Last

name

|

26

|

40

|

A

|

Required

|

|

|

First

name and middle initial

|

41

|

55

|

A

|

Required

|

|

|

Address

|

Last

known address

|

||||

|

Extra

address (e.g. Apartment#)

|

56

|

85

|

A

|

Required

|

|

|

Street

address

|

86

|

115

|

A

|

Required

|

|

|

City

|

116

|

135

|

A

|

Required

|

|

|

State

|

136

|

137

|

A

|

Required

|

|

|

Zip

code

|

138

|

146

|

A

|

Required

|

|

|

Bad

address indicator

|

"Y"

to indicate that the address provided is known to be bad. (You have had

returned mail)

|

147

|

147

|

A

|

Required

|

|

Social

security number

|

Debtor's

SS#

|

148

|

156

|

N

|

Required

|

|

Date

of birth

|

Debtor's

date of birth is used to accurately identify the debtor (CCYYMMDD)

|

157

|

164

|

N

|

Optional

but recommended

|

|

Home

phone

|

Home

number

|

165

|

174

|

N

|

Optional

but recommended

|

|

Work

phone

|

Work

number

|

175

|

184

|

N

|

Optional

|

|

Bad

phone numbers

|

Numbers

previously removed - considered bad numbers. Provide up to 20 numbers.

|

185

|

384

|

N

|

Recommended

|

|

Search

type

|

Service

required

blank = Basic search 1 = Advanced (with POE) 2 = Asset search |

385

|

385

|

A

|

Once we have retrieved the data and used it to work the accounts, we will send

back one file to your system (Data "upload"). Following is a format

of the file we will supply.

|

Field

|

Description

|

Starting

at

|

Ending

at

|

Type

(A/N) |

Comments

|

|

Your

account reference#

|

The

unique number assigned to an account. Something we will pass back to you

to update your system.

|

1

|

25

|

A

|

|

|

Date

of birth

|

Debtor's

date of birth (YYMMDD)

|

26

|

31

|

N

|

May

be what was supplied

|

|

Age

|

Age

of debtor

|

32

|

34

|

N

|

|

|

Address

|

New

address if supplied address was bad

|

||||

|

Extra

address (e.g. Apartment#)

|

56

|

85

|

A

|

||

|

Street

address

|

86

|

115

|

A

|

||

|

City

|

116

|

135

|

A

|

||

|

State

|

136

|

137

|

A

|

||

|

Zip

code

|

138

|

146

|

A

|

||

|

Home

phone

|

Home

number

|

155

|

164

|

N

|

|

|

Work

phone

|

Work

number

|

165

|

174

|

N

|

for

advanced searches

|

|

Other

information

|

Up

to 4 other possible contacts may be provided

|

||||

|

Type

1

|

Type

code for contact

AD=Additional debtor information PH - additional debtor phone information CE - Possible cell phone 1D=1st degree relative 2D=2nd degree relative RE - Relative information, degree is not known AS=Associate PE=Place of employment |

175

|

176

|

A

|

|

|

Name

|

Name

of contact

|

177

|

191

|

A

|

|

|

Address

|

Address

of contact

|

192

|

236

|

A

|

|

|

Phone

|

Phone

number for contact

|

237

|

246

|

N

|

|

|

Type

2

|

Type

code for contact

|

247

|

248

|

A

|

|

|

Name

|

Name

of contact

|

249

|

263

|

A

|

|

|

Address

|

Address

of contact

|

264

|

308

|

A

|

|

|

Phone

|

Phone

number for contact

|

309

|

318

|

N

|

|

|

Type

3

|

Type

code for contact

|

319

|

320

|

A

|

|

|

Name

|

Name

of contact

|

321

|

335

|

A

|

|

|

Address

|

Address

of contact

|

336

|

380

|

A

|

|

|

Phone

|

Phone

number for contact

|

381

|

390

|

N

|

|

|

Type

4

|

Type

code for contact

|

391

|

392

|

A

|

|

|

Name

|

Name

of contact

|

393

|

407

|

A

|

|

|

Address

|

Address

of contact

|

408

|

452

|

A

|

|

|

Phone

|

Phone

number for contact

|

453

|

462

|

N

|

|

|

Trace

code 1

|

Result

code

470=New phone found 471=New address found 473=No phone found 474=No address found 476=No information found |

463

|

465

|

N

|

|

|

Trace

code 2

|

Result

code

|

466

|

468

|

N

|

|

|

Note

1

|

Notes

|

469

|

493

|

A

|

Supporting

notes

|

|

Note

2

|

Notes

|

494

|

518

|

A

|

|

|

Note

2

|

Notes

|

519

|

543

|

A

|

|

|

POE

name

|

Place

of employment

|

544

|

568

|

A

|

for

advanced searches

|

|

POE

address

|

POE

address line 1

|

569

|

593

|

A

|

for

advanced searches

|

|

POE

address line 2

|

594

|

618

|

A

|

for

advanced searches

|

|

|

Search

type

|

Service

required

blank = Basic search 1 = Advanced (with POE) 2 = Asset search |

619

|

619

|

A

|

You will update the system

using programs written by your software provider ot your technical team, based

on the information we return. You are responsible for this programming and

the associated costs.

The following describes what is done in Intelec as a guideline for what you could do with your own system..

The

following is provided as a guideline for updating your system with the data

supplied. It refers to the collection product Intelec.

With Intelec, we will assume that the information we provided was good,

until it is contradicted. Some of the on-screen reporting will show a success

or accuracy rate. That starts out at 100%. It changes when the user tells

the system that the information supplied was not accurate. How can you tell

the system that the information supplied was not accurate? You will

set up two Smart Codes called "Phone information was bad" and

"Address supplied was bad". You would train collectors to apply

those Smart Codes when applicable. The address-related Smart Code could

also be applied by your returned mail logic. These Smart Codes would automatically

update your statistics and reflect in the success or accuracy rates related

to the service.

THE TECHNICAL CHALLENGES

The major challenge we face is timing the movement of data between the different platforms based on what you have to do on your system (get accounts into the skip-tracing files) and the time differences between the United States and the offshore operations. Based on our experience, the best time to perform these operations would be at the end of the offshore operation's working day. That is presently between 6 AM and 8 AM EST. Your nightly processing would have completed and we would have a procedure similar to the following -

For more information, Tamara Perera (Quantrax Corporation) at tamara@quantrax.com.

Quantrax's web site is www.quantrax.com